BFSI

We transformed portfolio management

through intelligent automation

We made a visible and measurable impact to our client's business

90%

Reduction in man-hours

100%

Automated deck generation

Zero

Manual data entry errors

Challenge

INDUSTRY OVERVIEW

Wealth management firms manage complex portfolios across multiple investors, each holding assets in various Demat accounts through depositories like NSDL and CDSL. Relationship Managers (RMs) typically oversee 5-10 investors grouped into categories, with each group containing 5-6 individual investors. The ability to provide timely, accurate portfolio insights is critical to maintaining client relationships and delivering strategic investment recommendations.

However, the traditional approach to portfolio analysis relies heavily on manual processes that consume significant time and resources while introducing opportunities for human error.

THE PROBLEM

Our client, a leading wealth management firm, faced mounting challenges in their portfolio analysis workflow. RMs were managing investor groups without a centralized view of overall portfolio performance, making it difficult to understand consolidated portfolio values and key performance indicators across their book of business.

The process of extracting transactional data from NSDL and CDSL statements, mutual fund reports from CAMS and MF Central, and even Excel files required manual effort. Beyond data extraction, developing detailed client-specific insights and creating presentation decks for client discussions consumed significant man-hours, delaying the delivery of actionable recommendations.

The firm needed an intelligent, automated solution that would transform raw data from multiple sources into comprehensive, client-ready insights without manual intervention.

OUR ROLE

We designed and built a GenAI-powered solution that automates the entire workflow, from extracting transactional data across multiple statement formats to generating personalized portfolio scorecards, insights, and recommendation decks ready for client presentation.

Our approach

Methodology

Ganit addressed the challenge by implementing a comprehensive three-layer solution:

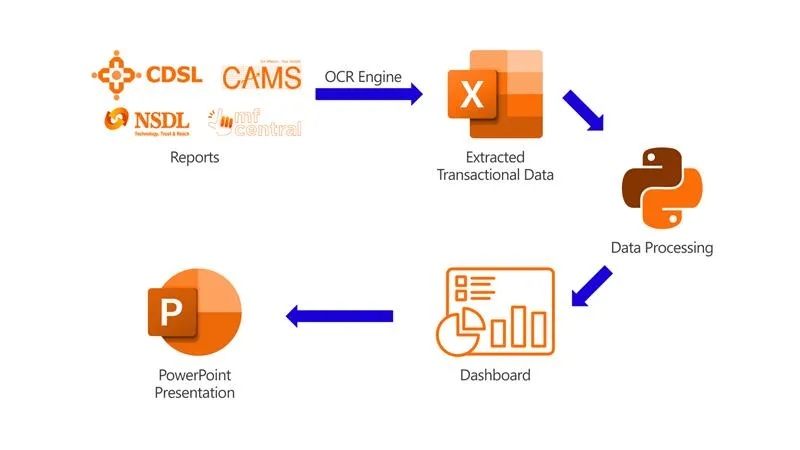

Intelligent Data Extraction

We deployed an advanced OCR engine pipeline utilizing Textract and a proprietary parser to extract transactional data from diverse sources including CAMS statements, CDSL and NSDL reports, MF Central documents, Excel files, PDFs, and screenshots. The system automatically identifies document types and applies the appropriate extraction logic, eliminating manual data entry entirely.

GenAI-Powered Analysis Engine

The extracted data flows into an LLM-based engine that dynamically generates Python code to process the information. This code automatically creates visualizations, calculates portfolio scores using defined algorithms and rule sets, and consolidates data across multiple investors. Each RM receives a personalized dashboard displaying consolidated portfolio values and KPIs for their investor groups.

Automated Presentation Generation

The solution automatically generates standardized, client-specific presentation decks with minimal to no manual intervention. These decks include portfolio scores, performance insights, asset allocation analysis, and tailored recommendations. All documents came formatted and ready for immediate client discussions.

Security-First Design

Given the sensitive nature of financial data, we implemented strict BFSI compliance protocols. All Personally Identifiable Information (PII), including PAN numbers, Aadhaar details, phone numbers, addresses, and unique identifiers, is completely excluded from LLM processing, not merely masked. Only aggregated numerical data such as portfolio values and asset allocation percentages is analyzed. All GenAI models operate exclusively within AWS infrastructure, where compliance frameworks explicitly prevent any customer data from being used for model training purposes.

How did we enable consumption?

The parsing engine was deployed and tested across a subset of RM portfolios to validate extraction accuracy and identify edge cases across different statement formats. This pilot phase allowed us to refine the parsing logic and ensure the system could handle the full variety of documents RMs encountered.

RMs began receiving automated dashboards and presentation decks for all their investor groups. The system was integrated into the firm's existing workflow, with dashboards accessible through a custom UI and presentation decks generated on-demand for client meetings.

A valuable difference

Our impact

We established an automated portfolio analysis workflow that reduced manual effort by approximately 90%. RMs now receive consolidated portfolio views and client-ready presentation decks without manual data extraction or document creation. The solution eliminated human error in data entry and dramatically accelerated the turnaround time for delivering insights to clients.

The automated generation of standardized presentation decks transformed client engagement, enabling RMs to focus on strategic conversations rather than administrative tasks. By providing real-time access to consolidated KPIs and portfolio scores across investor groups, we empowered RMs to manage their books more effectively and deliver higher-value advisory services.

The security-first architecture ensured complete compliance with BFSI data protection standards, giving the firm confidence that sensitive client information remains protected while leveraging the power of GenAI for portfolio analysis.